The IRS's Foreign Financial Institution List

For investigators, the FFI List provides a starting place to track mutual and hedge funds

When you’re working on a story that involves foreign hedge funds, its often a slog to track down every fund a particular firm is offering. Take, for example, Falcon Edge Captial, (now d/b/a Alpha Wave), a firm run by Rick Gerson, an associate of Jared Kushner. Tracking down the actual incorporation names and countries of incorporation can take hours searching the financial press for announcements of new funds.

But there is a tool that can cut a lot of that time—The Foreign Financial Institutions List. In 2010, Congress passed the Foreign Account Tax Compliance Act. The IRS maintains a list of all foreign finanacial institutions who register under the Act.

In subsection (a) of section 1471 of the Internal Revenue Code, FATCA provides that:

In the case of any withholdable payment to a foreign financial institution which does not meet the requirements of subsection (b), the withholding agent with respect to such payment shall deduct and withhold from such payment a tax equal to 30 percent of the amount of such payment.

The 30% witholding is designed to induce foreign financial institutions to register with the Internal Revenue Service described in subsection (b) which forces foreign financial instututions to:

The purpose of this 30% withholding tax is to force foreign financial institutions to register with the IRS and give the U.S. authorities the capability to see what accounts U.S. taxpayers hold in foreign banks and investment entities.

(1)(A) to obtain such information regarding each holder of each account maintained by such institution as is necessary to determine which (if any) of such accounts are United States accounts, (B) to comply with such verification and due diligence procedures as the Secretary may require with respect to the identification of United States accounts, (C) in the case of any United States account maintained by such institution, to report on an annual basis the information described in subsection (c) with respect to such account, (D) to deduct and withhold a tax equal to 30 percent of— (i) any passthru payment which is made by such institution to a recalcitrant account holder or another foreign financial institution which does not meet the requirements of this subsection, and (ii) in the case of any passthru payment which is made by such institution to a foreign financial institution which has in effect an election under paragraph (3) with respect to such payment, so much of such payment as is allocable to accounts held by recalcitrant account holders or foreign financial institutions which do not meet the requirements of this subsection.

In other words, if the foreign financial institution will be forced to pay a 30% tax on every U.S. sourced payment unless the institution agrees to give up all the details on US accounts that the foreign financial institution holds.

The definition of a foreign financial institution, found in section 1471(d)(5) of the Internal Revenue Code, is quite broad, encompassing any entity that—

(A) accepts deposits in the ordinary course of a banking or similar business, (B) as a substantial portion of its business, holds financial assets for the account of others, or (C) is engaged (or holding itself out as being engaged) primarily in the business of investing, reinvesting, or trading in securities (as defined in section 475(c)(2) without regard to the last sentence thereof), partnership interests, commodities (as defined in section 475(e)(2)), or any interest (including a futures or forward contract or option) in such securities, partnership interests, or commodities.

This defininition does more than encompass foreign banks. The definition also covers most mutual funds and hedge funds, many of which are registered in low corporate tax jurisdictions like the Cayman Islands.

The IRS publishes this data as part of the Foreign Financial Institutions List. The IRS has kindly provided investigators a search and download tool the public can use. You can search by Global Intermediary Identification Number, by country, or you can just download the list in multiple formats. The list comes out monthly.

What’s even better is that they host an archive where you can look at prior months’ FFI lists going back to 2014. The December 2024 list shows over 122 thounsand entries including banks, various funds and other financial institutions.

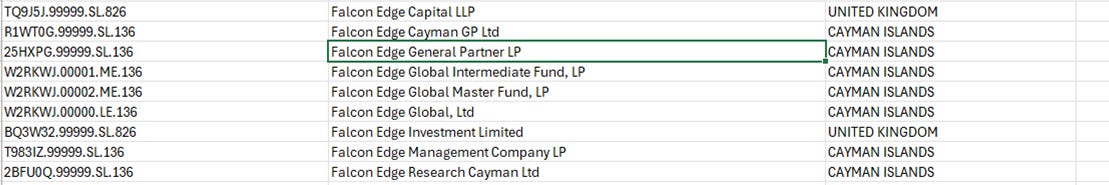

Turning back to our example of Rick Gerson’s Falcon Edge Capital (now doing business under the name Alpha Wave), we see that the December 2024 list includes a series of Falcon Edge funds and corporate entities:

We now have a list of current entities that Falcon Edge is running under its own name. This data can provide an important first step to find out more details about the funds.

Tools like the FFI List can help reporters figure out whose who in the complex world of hedge funds.